Accessed by selecting the Purchase Export menu option in the GL Mapping menu in Data Portal.

Provides a Venue with the ability to export Supplier Invoice related data from swiftpos and import them into their 3rd Party Financial application. Supplier Invoice data refers to completed Supplier Invoices.

Subjects ▼

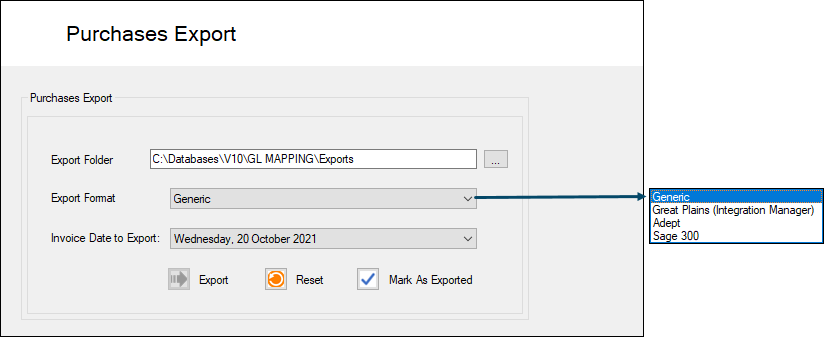

Purchases Export Screen ▲ ▼

Used to export completed Supplier Invoice data

Notes...

Invoices completed and having the same Posting Date as that of the selected Trading Date, will be selected for Export. Also, DO NOT enter Credit Notes into swiftpos as negative Supplier Invoices. Instead, it is recommended to create a Credit Note using the Credit Note Type option available when entering Supplier Invoices.

- Export Folder - Displays/Set the folder to which exported files will be written. Select the icon on the right to select a folder.

Notes...

Once exported, the data will be flagged as exported and the date will be removed from the Trading Date drop down list. This will ensure that the same data is NOT exported multiple times. It is important to note that even though the export for a specific Trading Date may NOT be completely successful, the Trading Date will still be removed from the drop down list. It is therefore VERY IMPORTANT to always review the Event Logs to ensure that any ERRORS are investigated and resolved in an appropriate manner.

- Export Format - Select from the drop down list one of the following:

- Generic - Refer to Generic Export Format for more information.

- Great Plains (Integration Manager) - Refer to Great Plains (Integration Manager) Export Format for more information.

- Adept - Refer to Adept Export Format for more information.

- Sage 300 - Refer to Sage 300 Export Format for more information.

- Invoice Date to Export - Select from the drop down list of dates the date for which Supplier Invoices are to be exported. This option is only available when the Generic Export Format option is selected above.

- Export - Select to commence the export of data. Once completed a prompt will be displayed confirming completion. The data will be exported and written to the Export Folder specified. Refer to Export File Specifications for more information.

Notes...

Once exported, the data exported will be flagged as exported and the date will be removed from the drop down list. This will ensure that the same data is not exported multiple times.

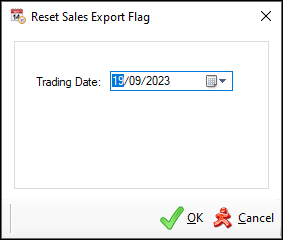

- Reset - Select to ensure that Supplier Invoice related data for the selected Trading Date is flagged as NOT Exported, so that they can be exported again. Select to display the following prompt:

- Continued ...

- Trading Date - Select the Trading Date that needs to be reset. That is, flagged as NOT exported.

Notes...

When resetting and exporting again, be sure that they DO NOT result in duplicates when imported into XERO.

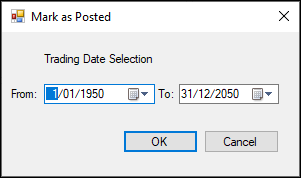

- Mark As Exported - Select to display the following prompt and select a range of Trading Dates to ensure all Supplier Invoice related data in the selected date range is flagged as exported.

Notes...

This is usually recommended when initially configuring swiftpos to export using this interface for the first time, and wanting to ensure that Supplier Invoice prior to a specific Trading Date are NOT exported. Also, it is useful when there is a requirement that all existing Supplier Invoice related transactions for a selected date range need to be flagged as exported.

- Continued ...

- From/To - Select the Trading Date date range for which data will be flagged as exported.

Export File Specifications ▲ ▼

- Generic Export Format

- Great Plains (Integration Manager) Export Format

- Adept Export Format

- Sage 300 Export Format

Generic Export Format ▲ ▼

- Name : Bills_YYYYMMDDYYMMSS (For example, Bills_20220824235959)

- Extension : TXT

- Type : CSV formatted file

- Headings : Not applicable

Header Record ▲ ▼

| Field | Example | Description |

| Line Type | H | Header Record |

| Account Type | AP | Accounts Payable |

| Supplier ID | Metcash | Supplier ID |

| Document Number | 202208040955 | Invoice Number |

| Invoice Date | 20220804 | Invoice Date (YYYYMMDD) |

| Invoice ID | 94 | Unique ID for Invoice |

| Spare | For future use | |

| Spare | For future use | |

| Spare | For future use | |

| Spare | For future use | |

| Spare | For future use | |

| Tax Total | 0.00 | For future use |

| Invoice Amount | 3322.00 | Invoice Amount (Inc Tax) |

| Field | Example | Description |

| Line Type | D | Detail Record |

| GL Code | 1-4100 | GL Code |

| Spare | For future use | |

| Tax Amount | 0.00 | For future use |

| Item Amount | 2940.00 | Item Amount (Exc Tax) |

Sample ▲ ▼

H,AP,Metcash,202208040955,20220804,94,,,,,,,0.00,3322.00

D,1-4100,,0.00,2940.00

D,6-0100,,0.00,10.00

D,6-0200,,0.00,2.50

D,6-0300,,0.00,1.00

D,2-4000,,0.00,368.50

Great Plains (Integration Manager) Export Format ▲ ▼

- Name : Supplier invoices.csv

- Extension : CSV

- Type : CSV formatted file

- Headings : First row

The exported file comprises of the following attributes:

- The first line in the file contains the headings.

- A carriage return exist after the last line in the file, indicating the end of the file.

- Values exported are summed by the the grouping of Product Groups (DistributonReference), GL Account Code (DistributionAccount) and then Tax indicator (LineTax).

- Freight, Rounding, Surcharges and Discounts will be included in separate lines within the file, with the DistributonReference differentiating the type of line. These lines will always be Exc Tax.

| Field | Description | Data Type | Data Length | Example |

| DocumentType | If the Invoice total (TotalIncAmount) is positive or zero, the value Invoice will be exported, otherwise the value Return will be exported. | Char | 10 | Invoice OR Return |

| VendorID | The Supplier ID the Invoice was associated with. | Char | 10 | COCA5 |

| DocumentNumber | Invoice Number entered when receipting the Invoice. | Char | 15 | 228458684 |

| Docate | Invoice Date entered when receipting the Invoice. | Datetime | DD/MM/YYYY | 16/05/2022 |

| TotalIncAmount* | Invoice Total including Tax. This is calculated by summing all the Inc Tax values of each Invoice item, rounded to 2 decimal places. | +Decimal** | 10866.59 | |

| TotalExAmount* | Invoice Total excluding Tax. This is calculated by summing all the Exc Tax values of each Invoice item, rounded to 2 decimal places. | +Decimal** | 10655.80 | |

| TotalGSTAmount* | The Total GST. This is calculated by summing all the GST Tax values of each Invoice item, rounded to 2 decimal places. | +Decimal** | 210.79 | |

| DistributionReference | The Description of the Product Group assigned to the Products at the time of the export. | Char | 30 | RTDs |

| IncAmount | The total value (including tax) of the Invoice items that were assigned to the Product Group at the time of the export. Note : The sum total of the IncAmount values exported for the same Invoice should equal the TotalIncAmount for that Invoice. | Decimal | 733.04 | |

| ExAmount | The total value (excluding tax) of the Invoice items that were assigned to the Product Group at the time of the export. Note : The sum total of the ExAmount values exported for the same Invoice should equal the TotalExAmount for that Invoice. | Decimal | 666.40 | |

| GSTAmount | The total value of the tax for the Invoice items that were assigned to the Product Group at the time of the export. Note : The sum total of the GSTAmount values exported for the same Invoice should equal the TotalGSTAmount for that Invoice. | Decimal | 66.64 | |

| DistributionAccount | The GL Account Code as assigned/mapped based assignments/mappings configured in the tabs to the right of the Accounts Setup tab above. | Char | 20 | 1-95-9050 |

| LineTax | Indicates whether a exported line item includes tax or not.If the Tax value of the exported line item equals zero, then the value of ‘N’ will be outputted.If the Tax value of the line item does not equal zero, then the value of ‘Y’ will be outputted. | Char | 1 | NOR Y |

| TaxableAmount | This will be, either or both of the following values: The sum total of all ExAmount values for all exported line items where the LineTax = N for the same Invoice And/Or The sum total of all ExAmount values for all exported line items where the LineTax = Y for the same Invoice | +Decimal* | 2107.84 |

* – Indicated that this value may be out by 1 cent, due to rounding, compared to the SwiftPOS equivalent value. However, it is important the export file balances. Hence, the value is ALWAYS calculated at the time of export, rather than sourcing the total from the Invoicein SwiftPOS. Also, the value exported is ALWAYS an absolute value. That is, regardless of the DocumentType it will be exported as a positive value. ** – +Decimal denotes the value exported is always an absolute value (that is, a positive value) regardless of the DocumentType.

Sample ▲ ▼

DocumentType,VendorID,DocumentNumber,DocDate,TotalIncAmount,TotalExAmount,TotalGSTAmount,DistributionReference,IncAmount,ExAmount,GSTAmount,DistributionAccount,LineTax,TaxableAmount

Invoice,Metcash,202208040955,04/08/2022,3322.00,2953.50,368.50,Rounding,1.00,1.00,0.00,6-0300,N,3.50

Invoice,Metcash,202208040955,04/08/2022,3322.00,2953.50,368.50,Surcharge,2.50,2.50,0.00,6-0200,N,3.50

Invoice,Metcash,202208040955,04/08/2022,3322.00,2953.50,368.50,Freight,11.00,10.00,1.00,6-0100,Y,2950.00

Invoice,Metcash,202208040955,04/08/2022,3322.00,2953.50,368.50,Spirits,3138.75,2790.00,348.75,1-4100,Y,2950.00

Invoice,Metcash,202208040955,04/08/2022,3322.00,2953.50,368.50,Wine,168.75,150.00,18.75,1-4100,Y,2950.00

Adept Export Format ▲ ▼

- Name : Bills_YYYYMMDDHHMMSS (For example, Bills_20220824235959)

- Extension : CSV

- Type : CSV formatted file

- Headings : Not applicable

Header Record ▲ ▼

| Field | Example | Description |

| Line Type | D | Detail Record |

| Intercompany | Leave blank | |

| GL Expense Account | 1-4100 | |

| Cost Centre | 101 | GL Division |

| Location Description | Wine | Product Group |

| Inc Amount | 168.75 | |

| Tax Amount | 18.75 |

| Field | Example | Description |

| Line Type | I or C | Invoice (I) or Credit Note (C) Both types may exist in the same file. Credit Notes will have negative values for amounts in the relevant amount fields. For reference I have also attached a file with credit notes CN20220701090532_FIX2.csv |

| Suppler Code | Metcash | Maximum 10 characters |

| Invoice No | 202208040955 | |

| Invoice Date | 04/08/2022 | YYYYMMDD |

| Invoice Due Date | Leave blank | |

| Second Reference | Optional. Could contain a Purchase Order Number. | |

| Total Invoice Amount (Inc GST) | 3322.00 | Sum of all Inc Amount values in all D type records. |

| Total Tax Amount | 368.50 | Sum of all Tax Amount values in all D type records. |

| Venue Code | G1 | Group Prefix |

| Field | Example | Description |

| Line Type | D | Detail Record |

| Intercompany | Leave blank | |

| GL Expense Account | 1-4100 | |

| Cost Centre | 101 | GL Division |

| Location Description | Wine | Product Group |

| Inc Amount | 168.75 | |

| Tax Amount | 18.75 |

H,G1,-2312.38,3

I,Metcash,202208040955,20220804,,,3322.00,368.50,G1

D,,1-4100,101,Wine,168.75,18.75

D,,1-4100,101,Spirits,3138.75,348.75

D,,6-0100,101,Freight,11.00,1.00

D,,6-0200,101,Surcharge,2.50,0.00

D,,6-0300,101,Rounding,1.00,0.00

C,Metcash,202208241340,20220824,,,-6834.38,-759.38,G1

D,,1-4100,103,Spirits,-6631.88,-736.88

D,,1-4100,103,Wine,-202.50,-22.50

I,HLW,202208241343,20220824,,,1200.00,0.00,G1

D,,1-4100,103,Spirits,1200.00,0.00

Sage 300 Export Format ▲ ▼

- Name : Supplier Invoices YYYMMDDHHMMSS.csv (For example, Supplier Invoices 20230920085011.csv)

- Extension : CSV

- Type : CSV formatted file

- Headings : First 5 rows

The exported file comprises of the following attributes:

- The first 5 lines in the file contains the column names for the 5 record types.

Record Type 1 ▲ ▼

| Field | Description | Data Type | Data Length | Example |

| RECTYPE | Record Type 1 | Char | 1 | 1 |

| CNTBTCH | ||||

| CNTITEM | ||||

| IDVEND | ||||

| IDINVC | ||||

| IDTRX | ||||

| ORDRNBR | ||||

| PONBR | ||||

| INVCDESC | ||||

| DATEINVC | ||||

| CODETAXGRP | ||||

| CODETAX1 | ||||

| TAXCLASS1 | ||||

| AMTTAXDIST | ||||

| AMTINVCTOT | ||||

| AMTTAXTOT | ||||

| AMTGROSTOT |

| Field | Description | Data Type | Data Length | Example |

| RECTYPE | Record Type 2 | Char | 1 | 2 |

| CNTBTCH | ||||

| CNTITEM | ||||

| CNTLINE | ||||

| DESCOMP | ||||

| TEXTDESC | ||||

| AMTTOTTAX | ||||

| SWMANLTX | ||||

| BASETAX1 | ||||

| TAXCLASS1 | ||||

| SWTAXINCL1 | ||||

| AMTTAX1 | ||||

| IDGLACCT | ||||

| AMTDIST |

| Field | Description | Data Type | Data Length | Example |

| RECTYPE | Record Type 3 | Char | 1 | 3 |

| CNTBTCH | ||||

| CNTITEM | ||||

| CNTPAYM | ||||

| DATEDUE | ||||

| AMTDUE |

| Field | Description | Data Type | Data Length | Example |

| RECTYPE | Record Type 4 | Char | 1 | 4 |

| CNTBTCH | ||||

| CNTITEM | ||||

| OPTFIELD |

| Field | Description | Data Type | Data Length | Example |

| RECTYPE | Record Type 5 | Char | 1 | 5 |

| CNTBTCH | ||||

| CNTITEM | ||||

| CNTLINE | ||||

| OPTFIELD |

RECTYPE,CNTBTCH,CNTITEM,IDVEND,IDINVC,IDTRX,ORDRNBR,PONBR,INVCDESC,DATEINVC,CODETAXGRP,CODETAX1,TAXCLASS1,AMTTAXDIST,AMTINVCTOT,AMTTAXTOT,AMTGROSTOT

RECTYPE,CNTBTCH,CNTITEM,CNTLINE,DESCOMP,TEXTDESC,AMTTOTTAX,SWMANLTX,BASETAX1,TAXCLASS1,SWTAXINCL1,AMTTAX1,IDGLACCT,AMTDIST

RECTYPE,CNTBTCH,CNTITEM,CNTPAYM,DATEDUE,AMTDUE

RECTYPE,CNTBTCH,CNTITEM,OPTFIELD

RECTYPE,CNTBTCH,CNTITEM,CNTLINE,OPTFIELD

1,1,1,Metcash,202110200803,12,,,,20211020,GST,GST,1,35.1200,351.2000,35.1200,386.3200

2,1,1,20,,Spirits,35.12,0,351.20,1,1,35.12,1-4100,386.3200

3,1,1,20,20211020,386.32

1,1,2,Metcash,202110200807,12,,,,20211020,GST,GST,1,132.2500,1060.0000,132.2500,1192.2500

2,1,2,20,,Spirits,131.25,0,1050.00,1,1,131.25,1-4100,1181.2500

2,1,2,40,,Freight,1.00,0,10.00,1,1,1.00,6-0100,11.0000

3,1,2,40,20211020,1192.25

1,1,3,Metcash,202110200812,12,,,,20211020,GST,GST,1,140.6300,1127.0000,140.6300,1267.6300

2,1,3,20,,Spirits,140.63,0,1125.00,1,1,140.63,1-4100,1265.6300

2,1,3,40,,Rounding,0.00,0,2.00,1,1,0.00,6-0300,2.0000

3,1,3,40,20211020,1267.63

1,1,4,Metcash,202110200912,12,,,,20211020,GST,GST,1,44.9600,359.7000,44.9600,404.6600

2,1,4,20,,Spirits,44.96,0,359.70,1,1,44.96,1-4100,404.6600

3,1,4,20,20211020,404.66

1,1,5,Metcash,202110200929,12,,,,20211020,GST,GST,1,44.9600,360.7000,44.9600,405.6600

2,1,5,20,,Spirits,44.96,0,359.70,1,1,44.96,1-4100,404.6600

2,1,5,40,,Rounding,0.00,0,1.00,1,1,0.00,6-0300,1.0000

3,1,5,40,20211020,405.66

1,1,6,Metcash,2021100937,12,,,,20211020,GST,GST,1,45.9600,369.7000,45.9600,415.6600

2,1,6,20,,Spirits,44.96,0,359.70,1,1,44.96,1-4100,404.6600

2,1,6,40,,Freight,1.00,0,10.00,1,1,1.00,6-0100,11.0000

3,1,6,40,20211020,415.66

1,1,7,Metcash,2021100942,12,,,,20211020,GST,GST,1,44.9600,364.7000,44.9600,409.6600

2,1,7,20,,Spirits,44.96,0,359.70,1,1,44.96,1-4100,404.6600

2,1,7,40,,Surcharge,0.00,0,5.00,1,1,0.00,6-0200,5.0000

3,1,7,40,20211020,409.66

1,1,8,Metcash,202110200954,12,,,,20211020,GST,GST,1,44.9600,362.7000,44.9600,407.6600

2,1,8,20,,Spirits,44.96,0,359.70,1,1,44.96,1-4100,404.6600

2,1,8,40,,Discount,0.00,0,3.00,1,1,0.00,6-0500,3.0000

3,1,8,40,20211020,407.66

End of article. ▲